Part 2: Formulating Blue Ocean Strategy

Ch. 3 Reconstruct Market Boundaries

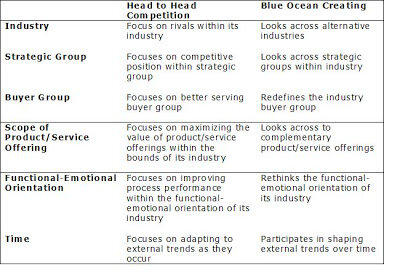

There are 6 fundamental strategies underlying many companies’ strategies. Most companies typically do the following:

1) Define their industry similarly and focus on being the best within it

2) Look at their industries through the lens of generally accepted strategic groups and strive to stand out in the strategic group they play in

3) Focus on the same buyer group, be it the purchaser, the user, or the influencer

4) Define the scope of the products and services offered by their industry similarly

5) Accept their industry’s functional or emotional orientation

6) Focus on the same point in time – and often on current competitive threats – in formulating strategy

Reconstruct accepted boundaries defining how to compete:

1) Look Across Alternative Industries

a. Alternatives are broader than substitutes.

b. A company competes not only with other firms in its own industry but also with companies in those other industries that produce alternative products or services.

Substitutes: products having different forms but offering the same functionality/core utility

Alternatives: products having different functions/forms but the same purpose

- sellers rarely consider how their customers make trade offs across alternative industries. A shift in price, change in model, even a new ad campaign can licit a tremendous response from rivals within an industry, but the same actions in an alternative industry usually go unnoticed.

- Many companies focus on delivering the most sophisticated technology instead of delivering exceptional value, leading to building overcomplicated offerings that miss the key commonalities valued by the mass of people.

- NetJets

- What are the alternative industries to your industry?

- Why do customers trade across them?

2) Look Across Strategic Groups Within Industries

a. Strategic groups are generally ranked by price & performance; each jump in price tends to bring a corresponding jump in some dimensions of performance.

b. Most companies focus on improving their competitive position within a strategic group. (ex. Luxury cars compete with luxury cars, economy with economy. Curves). Neither strategic group tend to heed what other strategic groups are doing because from a supply point of view they do not seem to be competing

c. Break out of this narrow vision by understanding which factors determine customers’ decisions to trade up or down from one group to another

i. Champion prefab houses

ii. Curves, Sony walkman,

d. What are the strategic groups in your industry?

e. Why do customers trade up for the higher group, and why do they trade down for the lower one?

3) Look Across the Chain of Buyers

a. Most competitors converge around a common definition of who the target buyer is.

b. Purchasers of the product may differ from actual users

c. In some cases there are important influencers.

d. These groups may overlap or differ, and they frequently hold different definitions of value

e. An industry typically converges on a single buyer group

f. By looking across buyer groups, companies can gain new insights into how to redesign their value curves to focus on a previously overlooked set of buyers (pharmaceutical companies vs. insulin users)

i. Bloomberg focused on users

ii. Novo Nordisk

- What is the chain of buyers in your industry?

- Which buyer group does your industry typically focus on?

- If you shifted the buyer group to your industry, how could you unlock new value?

4) Look Across Complementary Product & Service Offerings

a. In most cases other products/services affect their value.

b. Untapped value is often hidden in complementary products/services. They key is to define the total solution buyers seek when they choose a product or service. Think about what happens before, during and after your product is used. (movies & babysitters)

c. Buses & maintenance – the transit bus industry did not have to be a commodity price driven industry, but bus companies, focusing on selling buses at the lowest possible price, had made it that way.

d. Buses were normally made from steel (heavy, corrosive, hard to repair). NABI adopted fibreglass – cut costs of maintenance by being corrosion free, body repairs faster, cheaper, easier because fibreglass does not require panel replacements for dents & accidents; damaged parts are cut out & new fibreglass materials are easily soldered. Light weight cut fuel consumption, more environmentally friendly, required lower powered engines & fewer axles, resulting in lower manufacturing costs & more space inside the bus

- What is the context in which your product or service is used?

- What happens before, during & after?

- Can you identify the pain points?

- How can you eliminate these pain points through a complementary product/service offering?

5) Look Across Functional or Emotional Appeal to Buyers

a. Competition tends to converge on one of 2 possible bases of appeal.

b. Some industries compete principally on price, and function largely on calculations of utility; their appeal is rational.

c. Other industries compete largely on feelings; their appeal is emotional.

d. The appeal of most products is rarely intrinsically one or the other. It is usually a result of the way companies have competed in the past, which has unconsciously educated consumers on what to expect. Companies’ behaviour affects buyers expectations in a reinforcing cycle. Over time, functionally oriented industries become more functionally oriented; emotionally oriented industries become more emotionally oriented. No wonder market research rarely reveals new insights into what attracts customers. Industries have trained customers in what to expect. They surveyed they echo back “more of the same for less.”

e. 2 common patterns:

i. emotionally oriented industries offer many extras that add price without enhancing functionality. Stripping away those extras may create a fundamentally simpler, lower priced, lower cost business model customers would welcome

ii. functionally oriented industries can often infuse commodity products with new life by adding a dose of emotion

1. ex. Swatch

2. The Body Shop – transformed the emotionally driven industry of cosmetics into a functional, no nonsense cosmetics house

3. QB House (Japan) – moved away from 1 hour ritual [$27 - $45] to basic cuts in 10 min. [$9], raising the hourly revenue per barber nearly 50%, lower staff costs & less required retail space per barber

4. Cemex (Mexico) – shifted the orientation of its industry from functional to emotional. In Mexico cement was typically sold to the average do it yourselfer in an unattractive market with more noncustomers than customers. Few additions built as most families spent $ on community festivals/celebrations. Contributing to these events distinguished oneself in the community; not was a sign of arrogance/disrespect.

a. Therefore most of the poor had insufficient savings to purchase building materials, even though having a cement house is a Mexican’s dream.

b. Cemex launched Patrimonio Hoy. 10 people contribute 100 pesos/wk for 10 weeks. Each week a draw is made to see who wins the $1000 pesos in each of the 10 weeks, so all participants win once and receive enough to make a large purchase.

c. Instead of spending the winnings on a celebration, it is directed towards building room additions with cement. Cemex positioned cement as a loving gift.

d. Cemex set up a building materials club winner would receive the winnings not in pesos but the equivalent in building materials to complete an entire new room, delivery included, construction classes on how to, and a technical advisor who maintained relations through the project.

e. Competitors sold bags of cement; Cemex sells a dream, with innovative financing & construction know how.

f. They also through small festivities for the town when a room is finished to reinforce the happiness brought to the people & tradition

g. 20% more families are building additional rooms; families are now planning 2-3 more rooms than before; Cemex experiences 15% monthly growth, selling cement at higher prices. It has tripled cement consumption by do it yourselfers.

h. Predictability of cement quantities to be sold through this program has dropped their cost structure via lower inventory costs, smother production runs, & guaranteed sales (lowering the cost of capital). Social pressure makes defaults on payment low.

5. Pfizer with Viagra

- shifted the focus from medical treatment to lifestyle enhancement

6. Relationship businesses (insurance, banking, investing) have relied heavily on emotional bond between broker & client, and are ripe for change

- customers do not need hand holding & emotional comfort traditionally provided if the company does a better job of paying claims rapidly & eliminating complicated paperwork.

- Direct Line uses information technology to improve claims handling & passes saving on to customers through lower insurance premiums

- Vanguard Group (index funds) and Charles Schwab (brokerage services) are doing the same in the investment industry transforming emotionally oriented businesses based on personal relationships into high performance, low cost functional businesses

Does your company compete on emotional appeal, what elements can you strip out to make it functional?

If you compete on emotional appeal, what elements can you strip out to make it functional?

If you compete on functionality, what elements can be added to make it emotional?

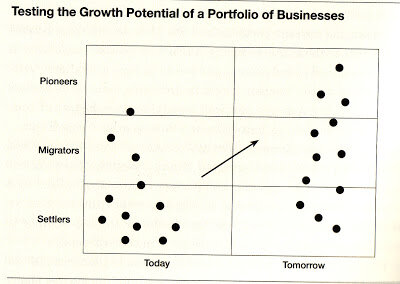

6) Look Across Time

- external trends affect businesses over time (environmental movement, internet, Lean philosophy)

Traditional companies:

- ask in which direction a technology will evolve, how it will be adopted, & whether it will be scalable.

Blue Ocean Strategy:

- ask how the trend will change value to customers and impact the company’s business model

By looking across time at what value a market delivers today to the value it might deliver tomorrow firms can shape their future. Finding insight in trends observable today.

3 Principles to assessing trends across time

Trends must

1. be decisive to your business

2. be irreversible

3. have a clear trajectory

Working backwards from the future vision, identify what must be changed today to unlock the new water.

Ex.

Apple & music sharing over the internet.

They also removed the key customer annoyance of having to buy the whole cd.

Cisco identified growing demand for high speed data exchange. 80% of all internet traffic today flows through Cisco products.

CNN – 1st real time news network

Sex in the City – acted on trend of increasingly urban & successful women struggling to find love & marry later in life

What trends have a high probability of impacting your industry, are irreversible, and are evolving in a clear trajectory?

How will these trends impact your industry?

How can you open up unprecedented customer utility?